Ireland, like most countries across Europe, is suffering from a housing shortage and cost of living crisis as housing supply and wages have not kept up with demographic demand and cost inflation.

Recent assessments in Ireland estimate a current shortfall of over 450,000 homes, which is not surprising as the country’s population has been increasing steadily since 1962.

As of the April 2022 census, Ireland’s population stood at 5.1 million people, an 8 per cent increase since the previous census in 2016. As of April 2024, the population was 5.38 million, up another 5.4 per cent.

Some 75 per cent of the population increase is because of net migration and only 25 per cent is due to natural increases (births exceeding deaths). Anecdotally, the population of Dublin has been increasing at a rate of about 33,000 per annum over the last three years.

What’s struggled to keep up with Ireland’s continued population increases is government policy and the country’s approach to infrastructure and housing.

While multiple governments have come and gone in the last 25 years, the Dublin region, the powerhouse of the national economy, and its other main cities, where much of the economic activity occurs, have not been given enough attention to allow them to thrive into the future.

The recently reviewed Irish National Planning Framework looks to limit the growth of the Dublin region, despite it being a huge draw for many businesses and employment. Where other countries look to reinforce their leading lights, we look to hold it back.

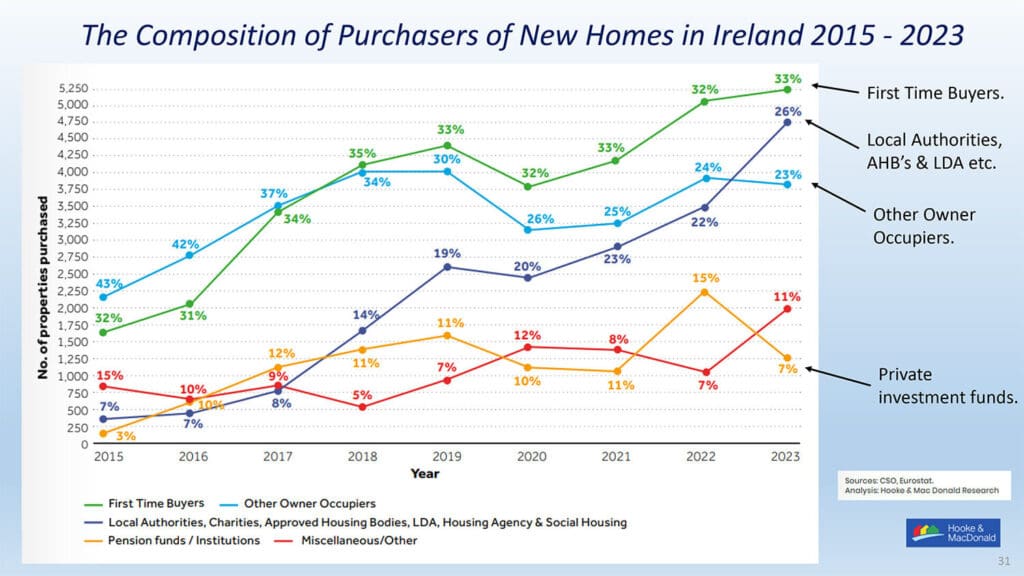

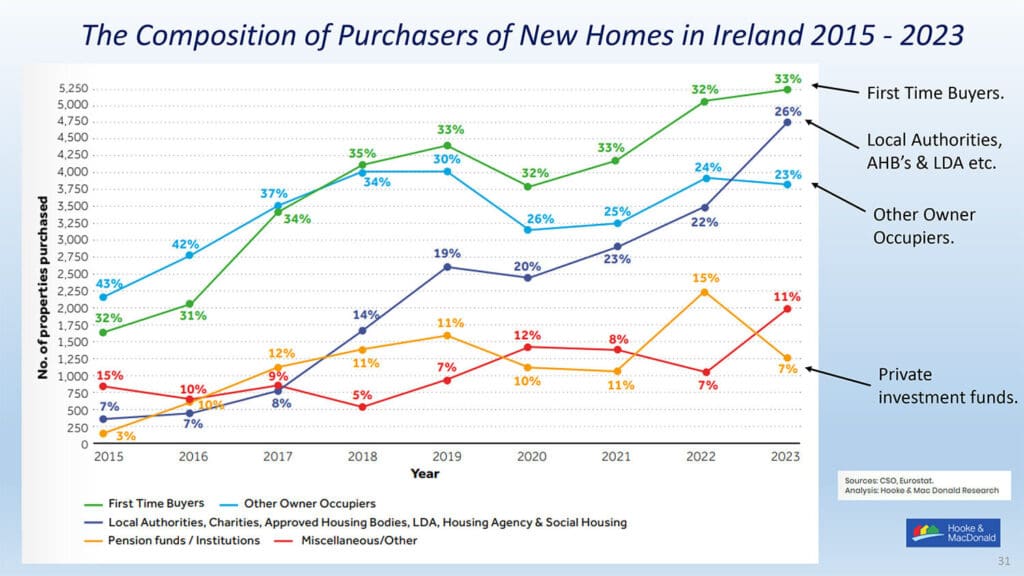

Hooke & MacDonald research revealed that the composition of new home buyers shows first-time buyers have risen to 33 per cent of the market, local authorities are on a similar trajectory and pension fund/institutions have halved in the past year

New homes trends

The new homes market has seen continued buoyancy throughout 2024. Dominated by first-time buyers, it is being spurred on by the surge in population growth.

The Help to Buy Scheme and the First Home Scheme have been hugely successful by giving confidence to builders and their funders to scale up new housing development and in getting thousands of people out of the rental sector or family housing and into their own homes.

What’s evident is that as prices increase, affordability is playing more of a part in people’s decision-making and location choices. There is a cohort of first-time buyers who will shop around extensively and are flexible on location.

New homes buyer types

First-time buyers are the biggest purchasers of new homes, accounting for about a third of sales since 2018 when they surpassed ‘other owner occupiers’ as new homes supply increased.

Local authorities, Approved Housing Bodies and the LDA have increased substantially over recent years and comprised 26 per cent of new home purchases last year. 2023 was the first year these bodies surpassed ‘other owner occupiers’, who were at 23 per cent for the year.

What’s notable, and expected, considering how the private rental sector has been decimated by the government’s introduction of the 2 per cent rent cap, increased interest rates, inflation and build costs – purchases by private investment funds halved in 2023 to only 7 per cent of all sales, and it is likely to fall more this year again.

Decimated rental sector

The government’s lack of a sustainable strategy, negative policies and widespread anti- landlord rhetoric have made investment in new rental housing in Ireland most undesirable.

Factors including the introduction of the rent cap three years ago all but closed the door on international capital to fund apartment developments in the private rental sector and this is now being seen on the ground.

There was downward pressure on rents in some locations in Dublin in 2023 and early 2024 when many internationally funded apartment developments were completed and came to the market for letting. This development pipeline and new supply had built up over many years but has now been cut off.

The shortages are becoming apparent again, especially as thousands of smaller landlords continue to leave the sector, forcing up rents.

Emergency programme essential

A key distinction between Ireland and other countries at present is that Ireland is experiencing multi-annual positive exchequer surpluses which the government can channel into new housing when many of our European neighbours are seeing significant shortfalls.

The extent of the challenges besetting the delivery of new homes for both the sale and rental markets make it imperative for the new government to immediately devise and implement an emergency programme for the housing sector with input from industry stakeholders.

This programme needs to make arrangements to have more land zoned and serviced for housing, facilitate timely planning permissions, embrace new house types to reflect changing demographics, implement measures to revitalise our cities and towns, facilitate the use of modern methods of construction, increase funding options for builders and developers, adjust the rent cap and provide stable conditions for institutional funding of new homes to own and to rent.

Without this approach the new government and the country will struggle with housing, similar to many before.

Source businesspost.ie