Between 2017 and the end of 2021 the best or ‘prime’ yields for Dublin new build apartment developments, known as forward sale multi-family investments, were 3.75 per cent.

This was what was consistently being secured by developers of these blocks, with funders able to underwrite investments at these levels.

During this period, interest rates across the EU were at historic lows, with the European Central Bank rates at zero per cent. This allowed the investors to pay the low yields, and the pre-sale contracts allowed developers to secure workable finance terms for development funding which facilitated the construction of over 22,000 across the wider Dublin area.

It’s worth pointing out that this new rental supply was only being seen in and around Dublin and not elsewhere in the country, despite there being the dire need.

Notwithstanding the challenges of the immediate post Covid period, the residential sector was largely unimpacted in Ireland with development continuing and thousands of people wanting to buy and rent.

It was the increased interest rates from early 2022 onwards that had the most devastating results on new supply in the private rental sector (PRS).

These increases along with the Irish Government’s introduction of the 2 per cent rent cap in November 2021 and general sentiment towards real estate killed new rental supply commencements in Dublin.

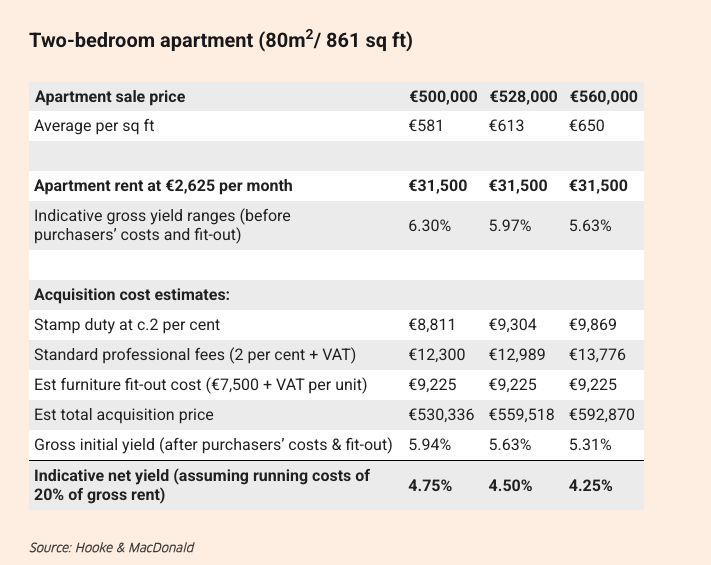

Today, the multi-family ‘prime’ yield is 4.75 per cent in Dublin. A straightforward calculation for a two-bedroom apartment (see table) shows where rents would need to be at for a developer of a new apartment today to sell it at €500,0000 to allow an investor to secure this return.

This table also shows the increase in the apartment sale price at the same rent if the yield is compressed downwards; a very material difference of €28,000 for a 25-basis point decrease from 4.75 per cent to 4.5 per cent.

Apartment viability and VAT

Valued Added Tax (VAT) on new homes in the UK is zero per cent and has been for many years.

Successive UK Governments there have recognised the importance of new homes supply, and the real impact the reduced VAT levels can have on fostering new construction.

VAT is effectively a cost. In Ireland there has been a belief that if VAT is reduced it will go to the builders profit only. However, this narrow view doesn’t take account of the fact that if something isn’t viable to build it’s not going to be built – there is no supply or profit.

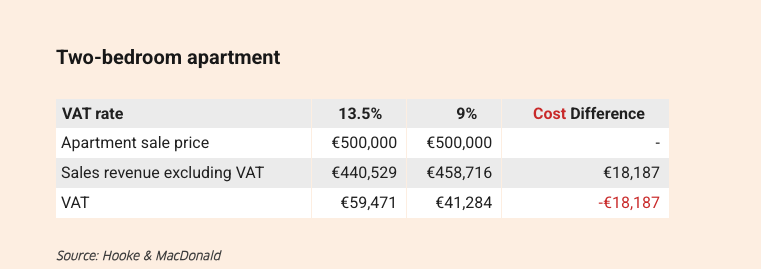

In Budget 2026 the Irish Government reduced VAT to 9 per cent on new apartments.

The Minister for Finance stated at the time ‘this reduction will help address the viability gap in apartment construction as part of a social policy to deliver more and higher density apartments’. The table below illustrates the monetary consequences of this reduction.

The Society of Chartered Surveyors Ireland December 2025 report “The Real Costs of New Apartment Delivery 2025” puts the cost excluding VAT of delivering a new build two-bedroom apartment in a medium rise suburban 3-6 storey block (Category 2) at approximately €500,000.

Therefore, the recently announced VAT reduction of 4.5 per cent, which equates to €18,187 as per the example in the table, is insufficient for the builder to secure a profit based on these figures and there is still €41,284 per apartment being paid to the Government in VAT.

The need for capital and international yield trends

It is estimated by the Department of Finance that Ireland needs over €20 billion a year in funding to allow for the construction of 50,000 new homes, of which over €8 billion will have to come from private funders.

As with Foreign Direct Investment, Dublin competes with other cities around Europe for capital. Residential investment net yields across comparable European cities currently range from around 3.75 per cent to 4.5 per cent – a good bit below Dublin.

These cities would include Berlin, Madrid, Barcelona, Amsterdam, Helsinki and Copenhagen. During the period of low interest rates these yields were closer to 3 per cent in these cities.

Dublin net yields

At a macro level, Dublin has many positive factors that influence net yields for Irish PRS accommodation.

For example, continuing and forecast population increases, as well as strong renter demographic need; housing supply shortfalls; Ireland is the only English-speaking member of the EU; and strong FDI; positive economic outlook and indicators, including Exchequer balances, strong employment and good incomes in many sectors. All of these attributes also drive demand for rental accommodation.

The more negative aspects, which investors are very conscious of, are multiple adverse Government interventions and regulations in the rental sector and the overall affordability of rents versus comparable cities in Europe.

At a micro level the quality of the new accommodation developed over the last 10 years by Irish developers is of an excellent standard, in many cases better than that being produced on the continent. This is recognised by investors.

One perspective is that if yields remain high in Ireland this allows investors to get a better return.

However, considering the viability challenges outlined above, if yields are high then there will be more limited opportunities for new development of rental accommodation; and investments that were made over the last 10 years are also challenged on capital value side, limiting liquidity.

What next for Dublin yields?

2025 was remarkable in that there was appetite from multiple new and existing investors for residential multi-family investments in Dublin. About €400 million worth of transactions was conducted and there is currently over €350 million of stabilised portfolios at the latter stages of negotiations for sale.

The change in rent regulations has been critical to this interest.

As more liquidity comes to the sector, the market develops further and matures, there will be the opportunity for yield compression to bring Dublin net yields closer to other comparable European cities.

This will assist increased delivery.

Donald MacDonald is a director at Hooke & MacDonald